A 57-year-old disability support pensioner is taking Australia's biggest payday lender Cash Converters to court, claiming it broke the law by repeatedly offering her loans it knew she would struggle to pay back.

Subscribe now for unlimited access.

$0/

(min cost $0)

or signup to continue reading

Documents lodged with the Federal Circuit Court this week show the pawnbroker is accused of offering 63 loans to the Melbourne woman in six years, despite knowing she was on the pension and fighting a gambling addiction.

The woman has asked to remain anonymous.

Her legal representative, the Consumer Action Law Centre, said Cash Converters had failed to assess the ability of a borrower to pay off a loan, as required under the 2013 payday lending reforms.

"In this case, our client alleges Cash Converters only assessed income and ignored significant warning signs," said Jillian Williams, the centre's director of legal practice.

"Lenders have a legal obligation to ensure loans aren't "unsuitable" and that they won't cause financial hardship. We allege Cash Converters gave repeated loans to a person when it was quite clear they were unsuitable."

The centre is calling for payday lending laws, which were overhauled in 2013, to be strengthened.

The federal government is in the middle of reviewing the laws regulating payday lenders, which often have exorbitant rates, about 240 per cent, typically to cash-strapped borrowers.

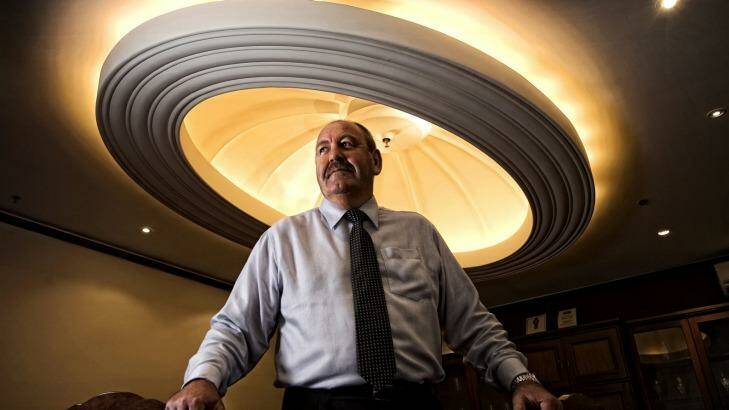

Cash Converters managing director Peter Cumins said the total fees under the claim amounted to $4,927.

"From 2013, she had 11 loans in 27 months and, according to the press release [from Consumer Action Law Centre], an average of 10 loans over six years, which from our perspective is not considered excessive under the changes to the laws made in 2013," he said.

"A total fee refund on those loans would be $288.20, hardly the basis for a Federal Court action or an assertion by CALC that: 'Payday lending reforms from 2013 have failed vulnerable Australians'.

He said, based on those figures, the tougher laws were working.

The legal case is the latest in a string of bad news for the embattled company. Its share price has spiralled down by 60 per cent since February.

In June, it reached a $23 million settlement with 37,500 past clients who were represented by legal firm Maurice Blackburn.

In August, the pawnbroker lost its major funding source after Westpac announced it would cut ties with the payday lending sector.

Consumer Action Law Centre chief executive Gerard Brody said the payday lending business model that profits through repeat borrowing by vulnerable Australians was wrong.

"People who are financially stressed should be referred to financial counselling and community support services – more and more loans exacerbate hardship, and don't help," he said.

The pensioner is seeking to have the loan transactions reopened and compensation representing the fees, interest and charges that were incurred under some the 63 loans.

She has relied on the disability support pension since 2006. She is battling a gambling addiction, almost exclusively on poker machines.

She said she was introduced to Cash Converters by a friend in 2007, when she was experiencing financial hardship.

An ABC Four Corners report aired earlier this year showed payday lenders were providing credit to heroin addicts, "doling out loans at one end of the shop after the addicted person had pawned goods at the front desk".

In another case, a man suffering a brain injury was signed up to multiple loans despite the fact he did not understand the documents he was signing.